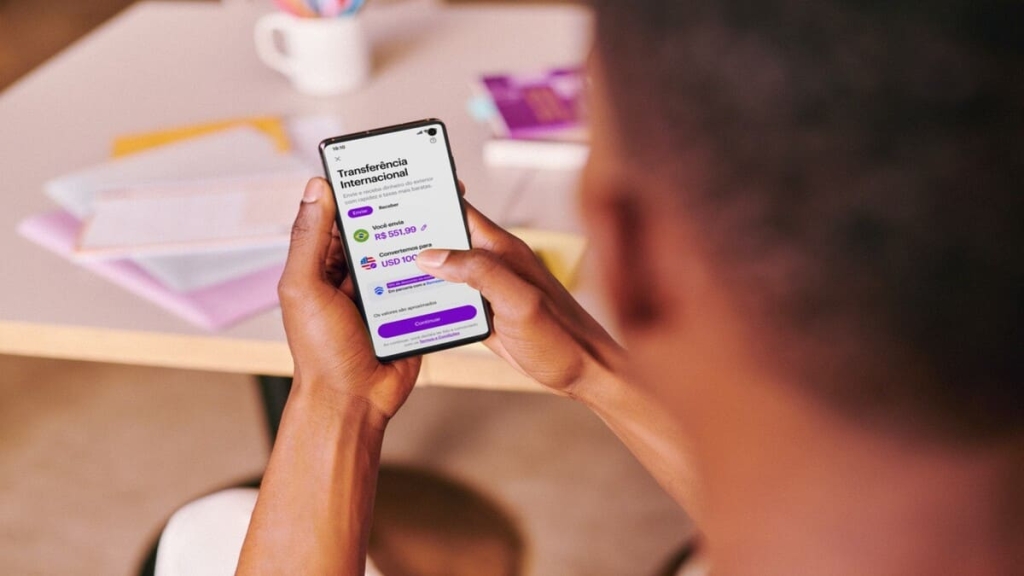

It is also possible to do international transfer, as long as the new tool is fully available to the Nubank Account holder through the option of sending remittances to other countries.

You can enjoy all these new app features through the app, which is available for iPhone e Android.

Nubank's partnership with the online remittance platform was one of the most anticipated in 2021 due to its simplicity and has been yielding results in 2022.

Completely legal for money transfers between countries and preferably with a 15% discount on international transfers between customers Nubank.

The company said that the partnership has worked very well even after the first few months and that customers will continue to receive incredible discounts on international rates, given the huge acceptance of these online broadcasts.

The company's idea was to offer all its customers and partners international transactions in a short space of time and 100% online, being super transparent and also very secure.

That's why the Nubank is one step ahead in international transactions worldwide. In other words, everything and everyone is connected in real time anywhere in the world with financial transactions that could not be otherwise, ensuring a partnership for administrators.

The idea is that any system should be smarter, faster, super intuitive and accessible to everyone every day.

Everything is super easy, just access your app Nubank and click on the International Transfer button. You must indicate the amount to be transferred, to which country and in which currency it is intended. As there is a limited number of partner countries.

Once this is done, the rest of the process is done automatically by the online remittance platform, as the entire process of sending funds is done from the platform already installed and accredited in the partner countries. It is truly a very useful platform in today's world.

Remember, the Nubank app shows real-time simulation so you know exactly how much you are sending, which means that the amounts sent will be automatically converted to the original currency or target currency. This way, you can know exactly how much you are sending.

The first big advantage is that with just one registered brother, you can send to more than 100 countries including: Chile, USA, Australia, Portugal, UK and others. The expansion process to countries in South America, Europe and Africa is already being extended.

Everything is fast, intuitive and the values can be displayed in the original currency or original Destination in real time.

Makes it easy to send references to executives, students, and employees in other countries.

This is a common question, as many users, especially those over 50, do not trust digital money transfer systems, perhaps because they do not really understand how they work. Which is understandable.

It is worth remembering that any digital financial process carried out today is very secure, as they are virtually inviolable systems.

This is why sending international money remittances online is completely safe and very simple, and there are also a number of viable methods for sending legal remittances outside of Brazil. This is why the online system is really here to stay.

To send international money transfers using the Nubank app, simply go to your app store and search for the term Nubank, download and install the app.

Everything is very simple and with a few clicks you can send your money transfers to partner countries through the app.

What is remarkable is that, despite the option in the Nubank app; International Transfer, the entire process is carried out by your partner

Did you like the content? If so, share it with your friends and on your social networks. Receive free content on our Portal. Thank you!

Source: Nubank